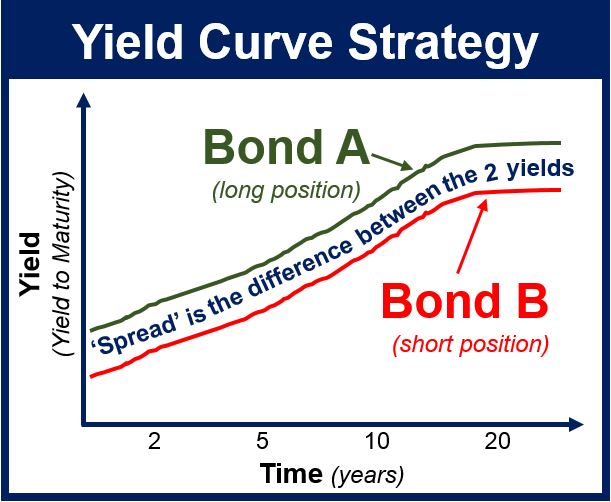

Spread Finance Bonds . One of the most common types is the bid. a bond credit spread, also known as a yield spread, is the difference in yield between two bonds with similar maturities but different credit qualities. for bonds, credit spread measures the yield difference between two bonds of the same maturity but of different credit quality. yield spread is the difference between the yield to maturity on different debt instruments. We analyze what bond spreads are, how they. in finance, a spread refers to the difference between two prices, rates, or yields. the spread of a bond, also called credit risk premium, helps us assess the level of credit risk in companies and countries. the difference between the yields of two different bonds, called a bond spread, can help you understand the potential risks and rewards for investing in.

from marketbusinessnews.com

for bonds, credit spread measures the yield difference between two bonds of the same maturity but of different credit quality. One of the most common types is the bid. a bond credit spread, also known as a yield spread, is the difference in yield between two bonds with similar maturities but different credit qualities. in finance, a spread refers to the difference between two prices, rates, or yields. the difference between the yields of two different bonds, called a bond spread, can help you understand the potential risks and rewards for investing in. the spread of a bond, also called credit risk premium, helps us assess the level of credit risk in companies and countries. We analyze what bond spreads are, how they. yield spread is the difference between the yield to maturity on different debt instruments.

What is a Yield Spread Strategy? Definition and Meaning Market

Spread Finance Bonds One of the most common types is the bid. We analyze what bond spreads are, how they. One of the most common types is the bid. a bond credit spread, also known as a yield spread, is the difference in yield between two bonds with similar maturities but different credit qualities. the difference between the yields of two different bonds, called a bond spread, can help you understand the potential risks and rewards for investing in. yield spread is the difference between the yield to maturity on different debt instruments. for bonds, credit spread measures the yield difference between two bonds of the same maturity but of different credit quality. the spread of a bond, also called credit risk premium, helps us assess the level of credit risk in companies and countries. in finance, a spread refers to the difference between two prices, rates, or yields.

From www.scribd.com

Understanding Yield Spread PDF Yield Curve Bonds (Finance) Spread Finance Bonds the spread of a bond, also called credit risk premium, helps us assess the level of credit risk in companies and countries. in finance, a spread refers to the difference between two prices, rates, or yields. We analyze what bond spreads are, how they. One of the most common types is the bid. the difference between the. Spread Finance Bonds.

From www.conseq.pl

Conseq CHART OF THE WEEK Corporate bond credit spreads remain elevated Spread Finance Bonds in finance, a spread refers to the difference between two prices, rates, or yields. the spread of a bond, also called credit risk premium, helps us assess the level of credit risk in companies and countries. One of the most common types is the bid. a bond credit spread, also known as a yield spread, is the. Spread Finance Bonds.

From studylib.net

Understanding Corporate Bond Spreads Using Spread Finance Bonds the spread of a bond, also called credit risk premium, helps us assess the level of credit risk in companies and countries. for bonds, credit spread measures the yield difference between two bonds of the same maturity but of different credit quality. in finance, a spread refers to the difference between two prices, rates, or yields. One. Spread Finance Bonds.

From www.rba.gov.au

Bonds and the Yield Curve Explainer Education RBA Spread Finance Bonds the difference between the yields of two different bonds, called a bond spread, can help you understand the potential risks and rewards for investing in. One of the most common types is the bid. yield spread is the difference between the yield to maturity on different debt instruments. in finance, a spread refers to the difference between. Spread Finance Bonds.

From fxaccess.com

How Bond Spreads Between Two Countries Affect Their Exchange Rate FX Spread Finance Bonds the spread of a bond, also called credit risk premium, helps us assess the level of credit risk in companies and countries. in finance, a spread refers to the difference between two prices, rates, or yields. We analyze what bond spreads are, how they. for bonds, credit spread measures the yield difference between two bonds of the. Spread Finance Bonds.

From www.fe.training

Credit Spreads Financial Edge Spread Finance Bonds in finance, a spread refers to the difference between two prices, rates, or yields. a bond credit spread, also known as a yield spread, is the difference in yield between two bonds with similar maturities but different credit qualities. One of the most common types is the bid. the difference between the yields of two different bonds,. Spread Finance Bonds.

From marketbusinessnews.com

What is the yield curve? Definition and examples Market Business News Spread Finance Bonds a bond credit spread, also known as a yield spread, is the difference in yield between two bonds with similar maturities but different credit qualities. We analyze what bond spreads are, how they. the spread of a bond, also called credit risk premium, helps us assess the level of credit risk in companies and countries. in finance,. Spread Finance Bonds.

From www.stlouisfed.org

COVID19, Policy and the Corporate Bond Market St. Louis Fed Spread Finance Bonds One of the most common types is the bid. the difference between the yields of two different bonds, called a bond spread, can help you understand the potential risks and rewards for investing in. for bonds, credit spread measures the yield difference between two bonds of the same maturity but of different credit quality. in finance, a. Spread Finance Bonds.

From www.bondsavvy.com

What Is a Credit Spread and How Does It Impact Bond Prices? Spread Finance Bonds for bonds, credit spread measures the yield difference between two bonds of the same maturity but of different credit quality. yield spread is the difference between the yield to maturity on different debt instruments. We analyze what bond spreads are, how they. the difference between the yields of two different bonds, called a bond spread, can help. Spread Finance Bonds.

From www.researchgate.net

Corporate Bond Spreads and the External Finance Premium Download Spread Finance Bonds One of the most common types is the bid. for bonds, credit spread measures the yield difference between two bonds of the same maturity but of different credit quality. the difference between the yields of two different bonds, called a bond spread, can help you understand the potential risks and rewards for investing in. a bond credit. Spread Finance Bonds.

From www.inkl.com

What Is Bond Credit Spread? Example and How to… Spread Finance Bonds the spread of a bond, also called credit risk premium, helps us assess the level of credit risk in companies and countries. for bonds, credit spread measures the yield difference between two bonds of the same maturity but of different credit quality. in finance, a spread refers to the difference between two prices, rates, or yields. We. Spread Finance Bonds.

From www.investopedia.com

What is the Agg or Bloomberg Barclays Aggregate Bond Index? Spread Finance Bonds yield spread is the difference between the yield to maturity on different debt instruments. the spread of a bond, also called credit risk premium, helps us assess the level of credit risk in companies and countries. the difference between the yields of two different bonds, called a bond spread, can help you understand the potential risks and. Spread Finance Bonds.

From marketbusinessnews.com

What is a Yield Spread Strategy? Definition and Meaning Market Spread Finance Bonds a bond credit spread, also known as a yield spread, is the difference in yield between two bonds with similar maturities but different credit qualities. the difference between the yields of two different bonds, called a bond spread, can help you understand the potential risks and rewards for investing in. We analyze what bond spreads are, how they.. Spread Finance Bonds.

From www.researchgate.net

Marketwide bond yield spreads of financial vs. industrial bonds (a Spread Finance Bonds One of the most common types is the bid. the spread of a bond, also called credit risk premium, helps us assess the level of credit risk in companies and countries. a bond credit spread, also known as a yield spread, is the difference in yield between two bonds with similar maturities but different credit qualities. We analyze. Spread Finance Bonds.

From www.scribd.com

The Determinants of Sovereign Bond Spreads Theory PDF Bonds Spread Finance Bonds One of the most common types is the bid. the difference between the yields of two different bonds, called a bond spread, can help you understand the potential risks and rewards for investing in. We analyze what bond spreads are, how they. yield spread is the difference between the yield to maturity on different debt instruments. in. Spread Finance Bonds.

From fxaccess.com

How Bond Spreads Between Two Countries Affect Their Exchange Rate FX Spread Finance Bonds We analyze what bond spreads are, how they. the spread of a bond, also called credit risk premium, helps us assess the level of credit risk in companies and countries. a bond credit spread, also known as a yield spread, is the difference in yield between two bonds with similar maturities but different credit qualities. for bonds,. Spread Finance Bonds.

From www.awesomefintech.com

Credit Spread , Formula, & Examples AwesomeFinTech Blog Spread Finance Bonds a bond credit spread, also known as a yield spread, is the difference in yield between two bonds with similar maturities but different credit qualities. the spread of a bond, also called credit risk premium, helps us assess the level of credit risk in companies and countries. yield spread is the difference between the yield to maturity. Spread Finance Bonds.

From www.scribd.com

Pugachevsky Bond to CDS Spreads Swap (Finance) Bonds (Finance) Spread Finance Bonds for bonds, credit spread measures the yield difference between two bonds of the same maturity but of different credit quality. a bond credit spread, also known as a yield spread, is the difference in yield between two bonds with similar maturities but different credit qualities. yield spread is the difference between the yield to maturity on different. Spread Finance Bonds.